Beyond Motivation Hacks: Why Smart Credit Card Use Can Boost Your Finances?

For decades, personal finance gurus have debated the “right” way to manage debt. Many of

the popular strategies focus on behavioral motivation — helping people

gain psychological momentum as they chip away at multiple debts. Dave Ramsey, for

instance, famously advocates paying off all credit cards and avoiding them entirely,

framing them as a source of temptation and risk.

But for those who have progressed beyond the stage of struggling with consistency,

there's a higher level of financial optimization that deserves attention. It's time to

explore how disciplined use of credit cards, combined with rational debt

management strategies, can actually advance your financial health.

The Snowball vs. Avalanche Debate

Two of the most well-known debt repayment strategies illustrate the difference between

psychological motivation and financial efficiency:

1. Debt Snowball

Pay off the smallest balances first.

- Pros: Builds momentum, gives “quick wins,” encourages consistency.

- Cons: Typically results in paying more interest

and longer payoff time.

2. Debt Avalanche

Pay off debts with the highest interest rates first, regardless of

balance size.

- Pros: Minimizes total interest paid, shortens payoff timeline —

mathematically superior.

- Cons: May feel slower if one relies on emotional rewards for

motivation.

Behavioral finance research shows that while the Snowball method can help those

struggling to stay on track, it is suboptimal financially. For

individuals capable of maintaining disciplined repayment, the Avalanche method — or even

more advanced strategies — produces objectively better outcomes. You can compare the

outcomes of the two

methods in our

debt elimination

calculator

Moving Beyond Motivation Hacks

Many people still rely on psychological tricks to make financial progress. “Seeing a zero

balance” on one account feels like a win, even if overall debt hasn't changed much. But

for disciplined financial actors, this emotional boost is no longer necessary.

Consider someone who uses multiple credit cards responsibly, paying off the

statement balance in full each month. This person is effectively debt-free,

despite never seeing a zero balance on any card due to ongoing usage. Here's why this

behavior represents optimal financial progression:

- Interest avoidance: Paying in full every month eliminates interest

charges completely.

- Credit optimization: Consistent, full payments maintain low

utilization ratios and strengthen credit scores.

- Cash flow management: Thoughtful card usage allows for convenience,

shopping protection, rewards, and tracking spending without

incurring debt.

- Rational mindset: Focus is placed on total financial efficiency

rather than emotional reinforcement.

Counterpoint to a finance guru

Dave Ramsey's advice to avoid credit cards entirely stems from a practical concern: many

people misuse them and incur high interest, ultimately falling into a debt trap. For

beginners or inconsistent spenders, his caution is valid.

However, for disciplined users, strict avoidance is not only unnecessary but also

potentially suboptimal, considering the following factors:

- Opportunity cost: Using credit cards responsibly can generate

rewards (cashback, points, or travel benefits) that paying entirely in cash cannot

replicate.

- Credit history: Active, well-managed credit contributes positively

to your credit score, affecting mortgage rates, loan approvals, and financial

flexibility.

- Financial efficiency: Full monthly payments ensure no interest

accrues, making credit cards a neutral or even beneficial financial tool rather than

a liability.

In other words, a finance guru's one-size-fits-all approach may not account for those

who have mastered self-discipline and

rational financial planning. At higher

levels of financial literacy, credit cards are tools — not traps — and can enhance

long-term financial outcomes.

The Path Forward

Financial growth is a journey. Beginners often need strategies like the Snowball method

to stay on track. But those willing to measure, calculate, and optimize

should strive for higher-level financial behavior:

- Use interest rate-focused repayment strategies for any actual debt.

- Treat credit cards as cash flow management and rewards tools,

paying balances in full.

- Focus on total financial efficiency rather than per-account “wins.”

- Avoid unnecessary psychological shortcuts once consistent behavior is established.

By moving beyond motivation-based hacks, individuals can achieve both

financial freedom and optimization, turning tools like credit cards

into allies

rather than liabilities.

Conclusion

Debt management is often framed as a battle of motivation versus logic. Beginners may

need psychological reinforcement, but advanced financial actors understand that

mathematics and discipline outperform motivation hacks. Paying off debt

efficiently, using credit responsibly, and viewing finances holistically represents the

next stage in financial evolution — a stage where strict avoidance of

credit cards is unnecessary, and rational behavior becomes the true driver of financial

success.

Why Choosing Credit Over Cash Can Signal Financial Savvy — and Not Just Income

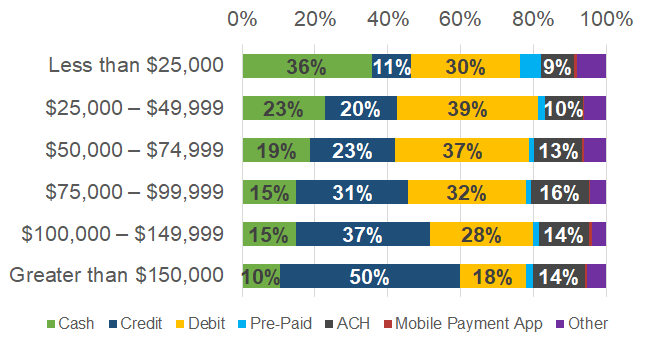

According to the Federal Reserve's 2023 survey Diary of Consumer Payment Choice,

there is a pronounced link between household income and payment method: households

earning less than $25,000 per year used cash for a much larger share of their

transactions than households earning more than $150,000. As showed in the following

figure, in that lowest-income group, roughly 36% of payments were made in cash

— more than three times the cash share of the highest-income households (10%). On the

flip side, credit card use rises sharply with income: among the highest-earning

households, around 50% of payments were via credit card — about four times the

credit card usage of the lowest-income group.

Shares of credit card use by household income (Source: FRB

Services)

Put simply: cash use remains disproportionately common among the lowest-income

households, while credit card use is significantly overrepresented among higher-income

ones.

Beyond Perception: Why Credit-Card Use Can Signal Financial Savviness

If you want to position yourself (or have others perceive you) as financially secure and

savvy — not just “not poor” but “smart with money” — using credit cards can carry

advantages beyond optics.

- Convenience and record keeping: Cards are widely accepted and

provide a built-in transaction history, whereas cash often lacks a clear record.

- Access to perks and financial flexibility: Many credit cards offer

rewards (cash back, points, travel benefits), effectively reducing your cost of

living when used wisely.

- Signal of access to banking and credit infrastructure: Using a

credit card assumes you have and responsibly manage access to banking and a credit

line, implying financial stability.

- A modern, minimalist status signal: Paying with credit instead of

cash can feel more “normalized” in professional or social settings.

In other words, using credit cards (when financially responsible) doesn't just keep up

appearances. It can reflect actual financial competence and even provide tangible

benefits like rewards and record-keeping advantages compared to sticking with cash or

debit.

Considerations & Why It's Not Just About Showing Off

That said, this argument doesn't mean cash or debit is “bad,” or that people who use cash

are necessarily poor or irresponsible. There are valid reasons to rely on cash or debit:

budgeting, privacy, avoiding debt, or lack of access to a credit account. Indeed, the

report notes that many people still use cash, and that cash remains a “fallback” payment

method when necessary.

But if you do have access to credit, and you manage it well (e.g., pay

on time, avoid carrying balances, stay within means), then credit card use can function

as a subtle signal: that you are financially stable, comfortable, and savvy.

If You Care About How Others Perceive You — Using Credit Makes Sense

Social perceptions around money shape how people treat you: in professional settings,

social outings, or everyday interactions. If you want to avoid triggering assumptions

that you're in a low-income bracket, consistently using your credit card can silently

communicate that you have not only the means, but also the discipline.

Moreover, from a smart money standpoint, credit card use offers practical upside:

convenience, visibility, record-keeping, and rewards. So long as you treat it as a tool,

not as “easy debt”, using a credit card strategically can be both a financial

advantage and a social signal.

Conclusion

In today's payment landscape, where plastic (cards) increasingly dominates, your choice

of payment says more than you might think. According to the data from the Diary of

Consumer Payment Choice, using cash or debit tends to be strongly correlated

with lower household income, while credit card use is heavily skewed toward

higher-income groups.

If you care about how others might perceive your financial status, and if you have

access to credit and the discipline to pay it off, thoughtful credit card use isn't

about pretension; it can reflect real financial competence. In that sense, using credit

cards strategically can be both smart and socially advantageous.